MTD of such employee must be made under the Income Tax Deduction from Remuneration Rules 1994. Fines and penalties are generally not deductible.

Personal Tax Relief 2021 L Co Accountants

While Budget 2022 had announced.

. Under section 80RRB the tax deduction is applicable on the income earned by way of royalties and patents. Purchase of basic supporting equipment for disabled self spouse child or parent. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. The deduction is limited to 10 of the aggregate income of that company for a year of assessment.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Deductions mentioned below Chapter VIA Section 80D. Money Politics.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. In the first bracket of box 1 national insurance tax is levied at a rate of 2765.

The limit of. Starting from Malaysia income tax Year of Assessment 2014. You will be granted a rebate of RM400.

Please note that there has been a proposal to adjust the tax rate as of 2024 by introducing two new brackets. Exceptions also apply for art collectibles and. The standard deduction amounts will increase to 12550 for individuals.

Box 2 income is taxed at a flat rate of 269. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Such employee must serve under the same employer for a period of 12 months in a calendar year ie.

Jan 1 Dec 31. Tax rebate for Self. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay. A 1622020 INCOME TAX DEDUCTION FOR EXPENSES IN RELATION TO SECRETARIAL FEE AND TAX FILING FEE RULES 2020 Home.

If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. Under Section 80D of IT Act one can claim the deduction on the medical expenses.

Under section 80U of Income Tax Act tax deduction is applicable for disable people. As per section 80D the income tax exemption is applicable for those who have taken a medical insurance for themselves family as well as their parents. The SME company means company incorporated in Malaysia with a paid up capital of.

To avail the tax benefit under this section. TurboTax Online Free Edition customers are entitled to payment of 30 Limitations apply. Standard Deduction Amounts.

This tax rebate is why most Malaysia n fresh. A basic rate of 26 for the first 67000 euros in income per person and a rate of 295 for the remainder. Vote to change the tax rates.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. To ensure your MTD is your final tax you may need to request for other. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the thresholds set for the 37 ordinary tax rate. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. For the patent registered under the patent act1970 up to the amount of Rs300000 income tax can be saved.

Individual Income Tax In Malaysia For Expatriates

Income Tax Relief Items For 2020 R Malaysianpf

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax 2021 Major Changes Youtube

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

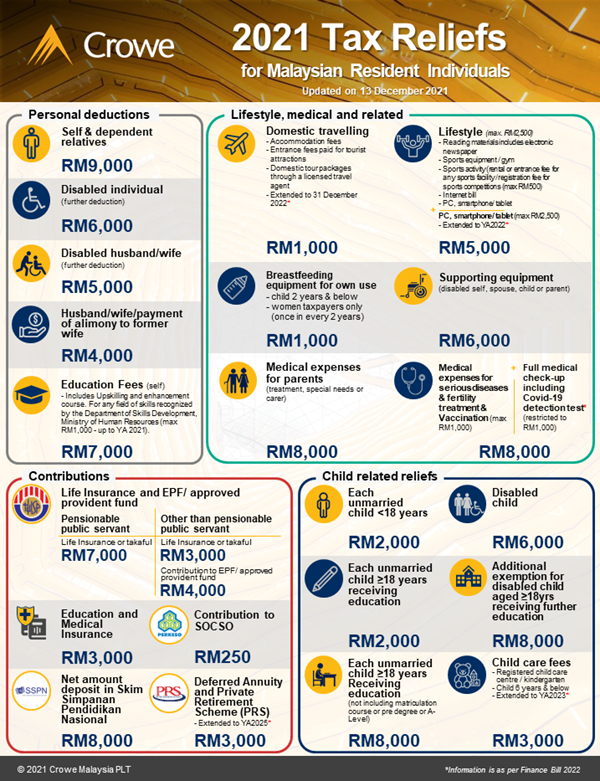

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Updated Guide On Donations And Gifts Tax Deductions

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Malaysia Personal Income Tax Relief 2022

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Lhdn Irb Personal Income Tax Relief 2020

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Cukai Pendapatan How To File Income Tax In Malaysia